Rapid Translate Team

A mortgage application translation falls under the category of financial translations. So, only specialists can handle the translation as they meet all the requirements for translating your financial statements. Thus, you can trust them to deliver a concise and accurate translation.

With a perfect translation of mortgage application, you’ll stand a better chance at getting the loan you need. So you can focus on securing the property and executing your repayment plan.

But to launch all these plans, you must translate your documents into the official language of the lending institution.

Table of Contents

Understanding Foreign Mortgage Application Procedures

Immigrants living abroad may want to purchase or secure landed properties. It’s no news that you can get a loan from mortgage institutions if you have clean financial records.

The institution will lend you a sum and ask you to repay with a specific interest rate. However, they will have the right to claim that property if you fail to meet the bargain. But if you do, it’s a win-win for you.

The above explanation shows that getting a mortgage loan involves sending an application with the required records and financial statements. Taking the right actions at the right time makes financing overseas properties easier.

You’ll have to process a mortgage to purchase a holiday home or own landed property in a foreign country. There are two ways to go about this. You can send a request for financing to a financial institution abroad. Alternatively, you can pursue a mortgage application through your local bank.

But this will only be possible if your local bank engages in international transactions. If your lender is in your country of residence, translation won’t be necessary. The process will be faster since they can easily access your credit history and financial scores.

However, some people prefer the first option, which introduces translation needs.

Aside from a financial translator, getting a legal translator to help you review foreign agreements and clauses will be nice. However, the entire process may be costlier due to the exchange rate and deposits.

You should also note that different countries have different regulations regarding the purchase of real estate by non-residents.

So, applicants should conduct proper research before applying for a mortgage.

The Importance of Having a Correct Mortgage Loan Translation

If you decide to pursue a foreign mortgage, you must submit several documents. Now, imagine that you request statements from your bank so you can email them to a foreign institution. The language barrier will come into play, thereby limiting the transmission of information.

For instance, if you’re a Czechoslovakian interested in a property in the U.S., you’ll have to translate documents from Czech to English. By doing so, the officer checking your documents to verify their authenticity will understand all the figures. The officer can extract all they need to process your loan application.

Aside from your bank statements, you must submit your credit score and employment details. Another essential document that must be present in your application is a description of the property you want to buy.

The mortgage company properly scrutinizes all these. The slightest error or lack of correlation can lead to denial. Therefore, the institution will not grant you a loan. So, a flawless application enhances your opportunity to get a loan with favorable interest rates.

That’s because loan agencies sometimes offer applicants with clean records lower rates. You can also apply for a higher loan amount with a good credit score. Now, if your translation contains an error due to negligence, you won’t be able to enjoy these benefits.

A good application translation will convey your repayment ability as an applicant. Hence, you’ll have a better competitive advantage over other foreign applicants.

Can You Do a Mortgage Loan Translation Yourself?

It’s wrong to handle mortgage translations yourself. Assuming that you’re bilingual, the idea of handling your mortgage loan translation might cross your mind.

However, though practical, self-translation in this situation isn’t ideal. Translation is more complex than having basic language-speaking skills or abilities.

You must understand idioms, grammar nuances, and culture’s influence on vocabulary. Moreover, translating mortgage documents requires knowledge of legal systems and foreign tax laws.

There are also specific financial terms that you must use in the appropriate context. Due to the fragile nature of the document involved and your aim, you shouldn’t leave anything to chance. The risk of learning on the job outweighs whatever money you hope to save through self-translation.

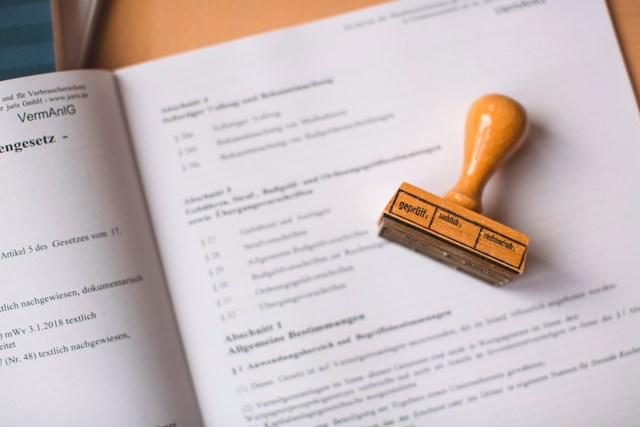

Besides, some loan institutions require certified translations, which only professionals who have passed their certification exams can issue.

So, even if you successfully translate your loan application documents, the institution can reject them on grounds of certification. So, follow the right channel and contact a professional for help.

How Much Does It Cost To Translate a Mortgage Application?

There is no specific price tag for the cost of mortgage translation. The amount you must pay depends on several factors, including the target language and location.

In some countries, translation services are costlier than others. Also, some languages are hard to learn and communicate with, thus necessitating a higher fee.

Some translators also consider their level of certification, skills, experience, and expertise when fixing quotes. They know that their services are pristine, so their price equals the value they offer.

Additionally, the volume of the work comes into play. Most translators charge per page or word count.

So, to get the best possible price, contact several translation services, get their quotes, compare, and go with the best.

However, don’t let the need to cut costs impede you from patronizing reliable and competent translators. Make sure you match quality with affordability to avoid regrets.

Mortgage Application Translation Service Providers

The mortgage application translation process is usually tedious. Therefore, various mortgage application apps help streamline it. Some can assist in collating the necessary documents and data and maintaining their format. Other service providers also help with paperwork.

Some agents or brokers can link you up with favorable lending institutions. However, the most important is mortgage application translation service providers. Knowing the importance of a flawless translation of mortgage applications, you should know that translation services play a huge role.

Therefore, you must explore your options to make the right decision. So, below is a list of mortgage translation services:

- Freelance translators.

- Translation apps and websites.

- Physical translation offices.

- Online translation agencies.

However, note that each option has its pros and cons. Freelance translators offer different rates, but some forge their certifications to get jobs. So, it may be tough to distinguish genuine, experienced translators from fakes or newbies.

On the other hand, free translation apps use machine-learning language, which is less efficient and sometimes inaccurate.

While locating physical translation services near you may be difficult, they’re among the best options. That’s because you can get concrete proof of expertise.

Comparatively, online translation companies offer several translators in different languages and fields. So, carefully analyze your options before deciding on a service provider.

The Best Mortgage Translation Provider

You may wonder which category of translation service provider to try. The most suitable option is to contact an online translation agency to avoid trial and disappointment. They’re the best because they’re readily available without the distance barrier.

Reputable agencies belong to credible associations in the translation industry. Their translators have experience and genuine proof of expertise.

In addition to translators, they work with editors who review and correct translations, ensuring a correct format. Moreover, they meet turnaround time and offer budget-friendly pricing.

So, if you’re looking for a translation agency to try, consider patronizing Rapid Translate. We’re a reputable, renowned company with a wealth of experience producing all kinds of translations.

Our services include financial, academic, medical, and mortgage application translation. We also cater to over 60 different languages. To experience the power of seamless communication, order an excellent translation that’ll enable you to secure your dream holiday home.